3.which of the Following Is an Example of a Deferral

What Is a Deferral in Accounting. Failure to record interest expense incurred but not yet paid c.

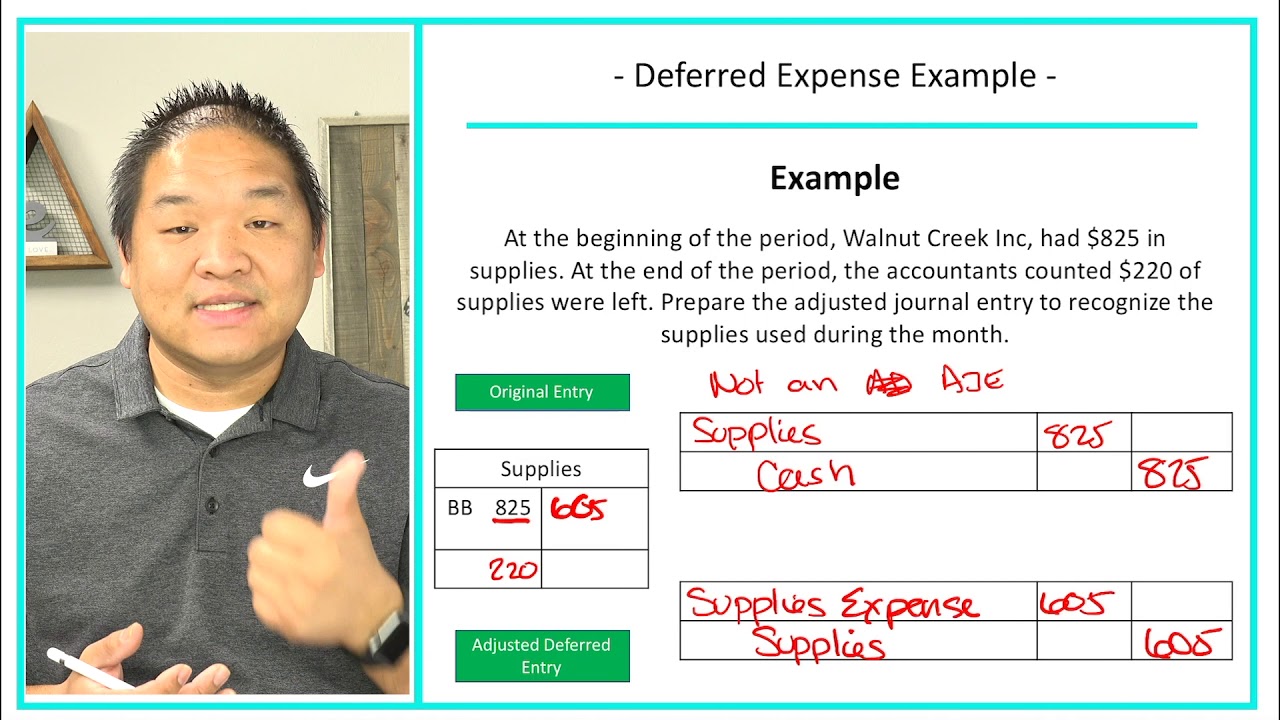

Financial Accounting Lesson 4 3 Deferred Expense Example Youtube

What is the difference between char a string and char p string.

. For instance the insurance payments that a firm makes precede the coverage period. Generally deferral refers to prepaid expenses or revenues that a firm makes. 30092011 Which of the following is an example of an accounting deferral.

Recognizing revenues earned but not yet recorded. Hence the cost of insurance is deferred on the balance sheet until the next payment. The remaining 10000 is deferred by reporting it.

None of the options listed. Which of the following is an example of a deferral. Also called deferred expenses.

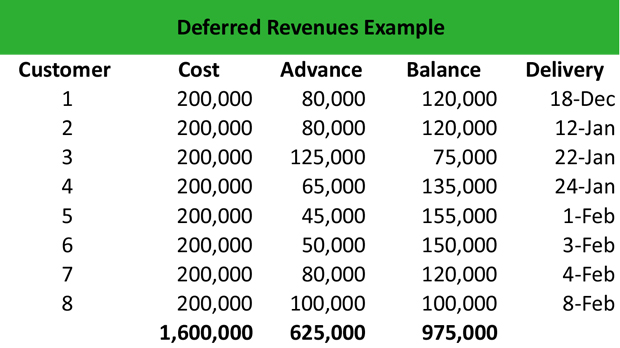

Deferred revenue occurs when cash has been received but revenue has not been earned. 300 Posted By. 1 Answer to Which of the following is an example of a deferral.

Which of the following is an example of a deferral. Assume that a company with an accounting year ending on December 31 pays a six-month insurance premium of 12000 on December 1 with insurance coverage beginning on December 1. Debit property taxes expense credit property taxes payable d.

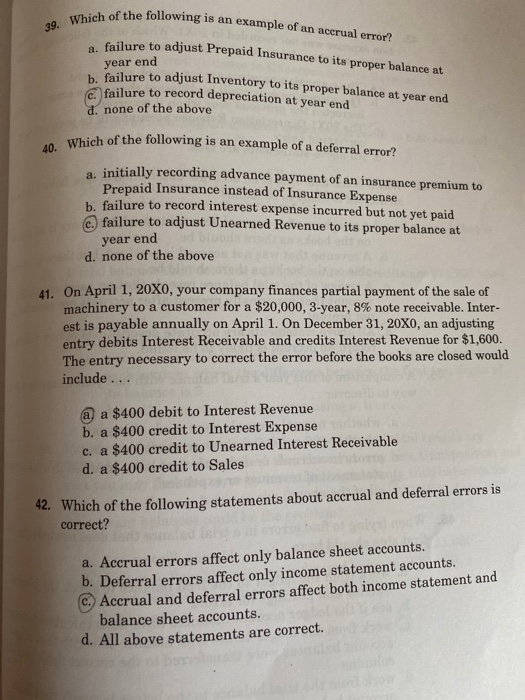

Which of the following is an example of a deferral error. Which of the following is an example of a deferral. Services have been rendered.

And char p string. Recognizing expenses incurred but not yet recorded. Recognizing revenues earned but not yet recorded.

Accruing year-end wages B. One-sixth of the 12000 or 2000 should be reported as insurance expense on the December income statement. 96 250 ratings Feedback Score View Profile.

Not all systems require energy to operate2Radiogenic decay is a primary source of heat within the Earth3If Earth were to stop receiving energy from the Sun it would. Examples of a Deferral. Which of the following is an example of a deferral or prepaid adjusting entry.

A liability created when a business collects cash from customers in advance of providing goods or services. The correct entry on January 1 is a debit entry of 36 for the cash. Accounts that are assets of a business because they represent items that have been paid for but will be used later.

BRecording the usage of office supplies during the period. What is the difference between char a string. Which of the following is an example of a deferral or prepaid adjusting entryRecording the usage of office supplies during the periodRecording salaries expense for employees not yet paidRecording revenue that has been earned but not yet receivedRecording interest expense incurred on notes payable not due until next year.

A deferral refers to money paid or received before a product or service has been provided. According to matching principle means any revenue recognize in period in which it incurred and expense recognize in period in which its incurred. Recording expired insurance recording unearned revenues recording supplies used When using accrual accounting in your business the issues of.

So we can understand deferral by this example. Which of the following is an example of a deferral. Debit accounts receivable b.

Subscription based services newspapers magazines television programming etc Prepaid rent. An example is a business selling a magazine subscription of 12 issues at the start of the year for 36. 05032016 0154 PM Due on.

Similarly a firm may receive a prepayment for a customer order. ARecording revenue that has been earned but not yet received. At1 Jan company paid12 month prepaid rent amount12000 at end of jan1000 would be expense out in income statement while rest11000 would recognized as prepaid asset.

Which of the following is an example of a deferral. Dont use plagiarized sources. When you earn revenue you make a credit entry to a revenue account.

Also called a deferred revenue. Which of the following is an example of a deferral. None of the above On April 1 20X0 your company.

Here are some examples of deferrals. Recording prepaid rent D. CRecording interest expense incurred on a notes payable not due until next year.

Get Your Custom Essay on. Recognizing expenses incurred but not yet recorded E. Which of the following is an example of a deferral.

1Accruing year-end wages 2Recording prepaid rent 3Recognizing expenses incurred but not yet recorded 4Recognizing revenues earned but not yet recorded. Cash has not changed hands and services have not been rendered. Answer of Which of the following is an example of a deferral.

Failure to adjust Unearned Revenue to its proper balance at year end d. Recognizing revenues earned but not yet recorded C. Initially recording advance payment of an insurance premium to Prepaid Insurance instead of Insurance Expense b.

AAccruing year-end wages bRecognizing revenues earned but not yet recorded cRecording prepaid rent dRecognizing expenses incurred but not. DRecording salaries expense for employees not yet paid. Which of the following is an example of a deferral.

Debit insurance expense credit prepaid insurance c. Debit salaries expense credit salaries payable. Expert Answer Solution for Which of the.

Request Deferral Of Interest Payment Template By Business In A Box Statement Template Letter Of Recommendation Lettering

Request Deferral Of Interest Payment Template By Business In A Box Statement Template Letter Of Recommendation Lettering

Solved 39 Which Of The Following Is An Example Of An Chegg Com

Comments

Post a Comment